On Feb. 27, 2024 Dearborn Public Schools will ask voters to renew a 10-year operating millage.

This vote is a RENEWAL of existing property taxes that fund district operations. The operating millage provides 16 percent, or $41 million, of the district’s general fund. This money is used for daily operations in the district including staff salaries, curriculum materials, classroom supplies, utility bills, busing, athletics and more.

This is NOT a bond question. Money is not intended for major building renovations or construction or other large capital expenses.

Find more detailed explanation in our slide presentation.

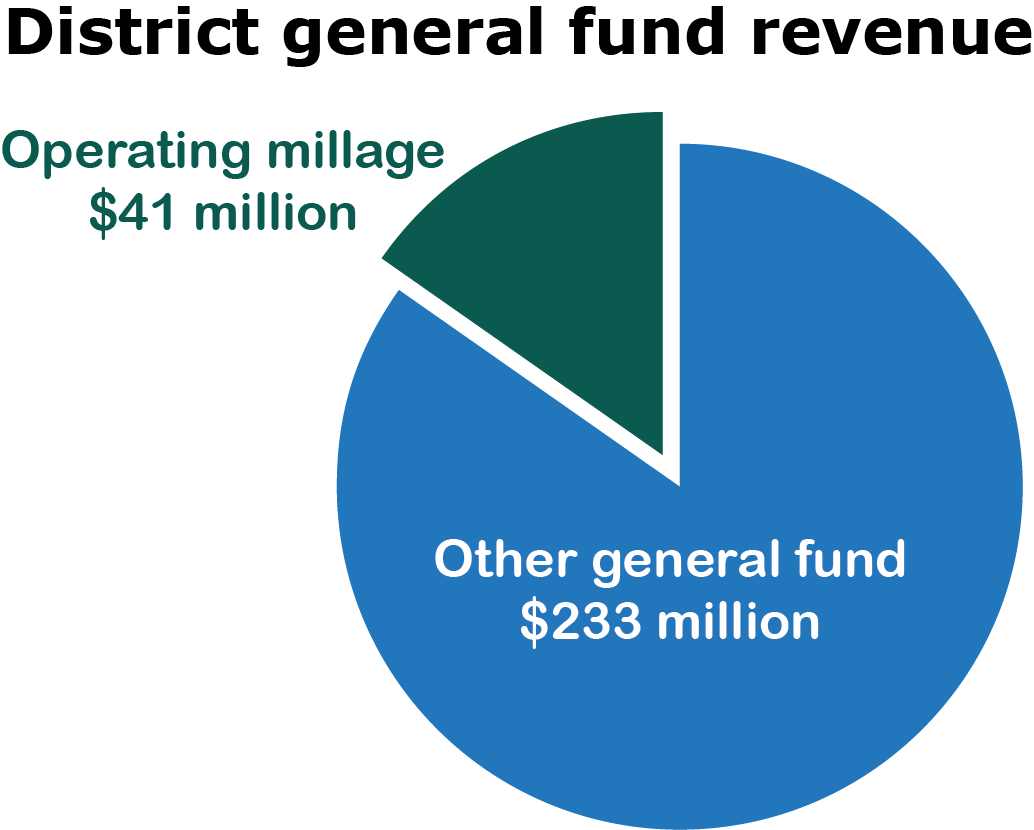

General fund revenue

Currently, $41 million of the district’s $274 million general fund comes from the operating millage approved by voters. If these funds were lost, the district would have to cut its spending to cover the reduction. The general fund covers all regular expenses including staff, curriculum materials, classroom supplies, utilities, building maintenance, athletics and much more.

Loss of this income would give Dearborn Schools one of the lowest per pupil funding revenues in the state and result in spending cuts across almost all schools and programs.

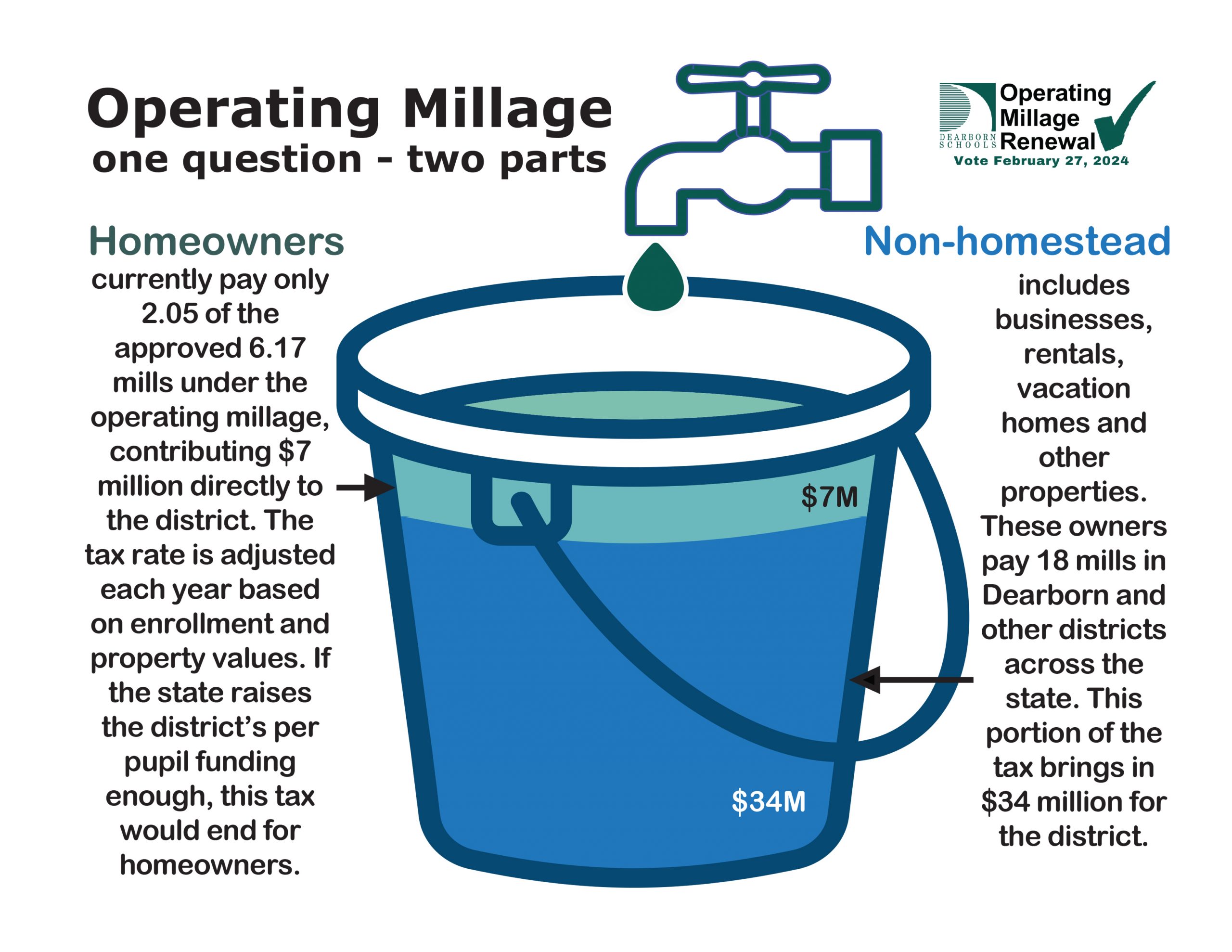

Operating Millage Renewal breakdown

The operating millage includes two parts – one for homeowners and one for non-homestead property.

For homeowners, voters previously approved a tax of up to 6.17 mills, but the ballot will ask to renew that rate at a maximum of 4 mills. The actual rate will vary depending on enrollment and total tax values. For the 2023-24 fiscal year, the district is collecting 2.04 mills. We expect the rate to settle at about 2.5 mills.

Non-homestead properties would continue to pay the 18 mills created when Proposal A changed school funding in 1994. Non-homestead properties includes businesses, commercial sites, rentals, and vacation homes. This portion of the tax generates $34 million for the district.

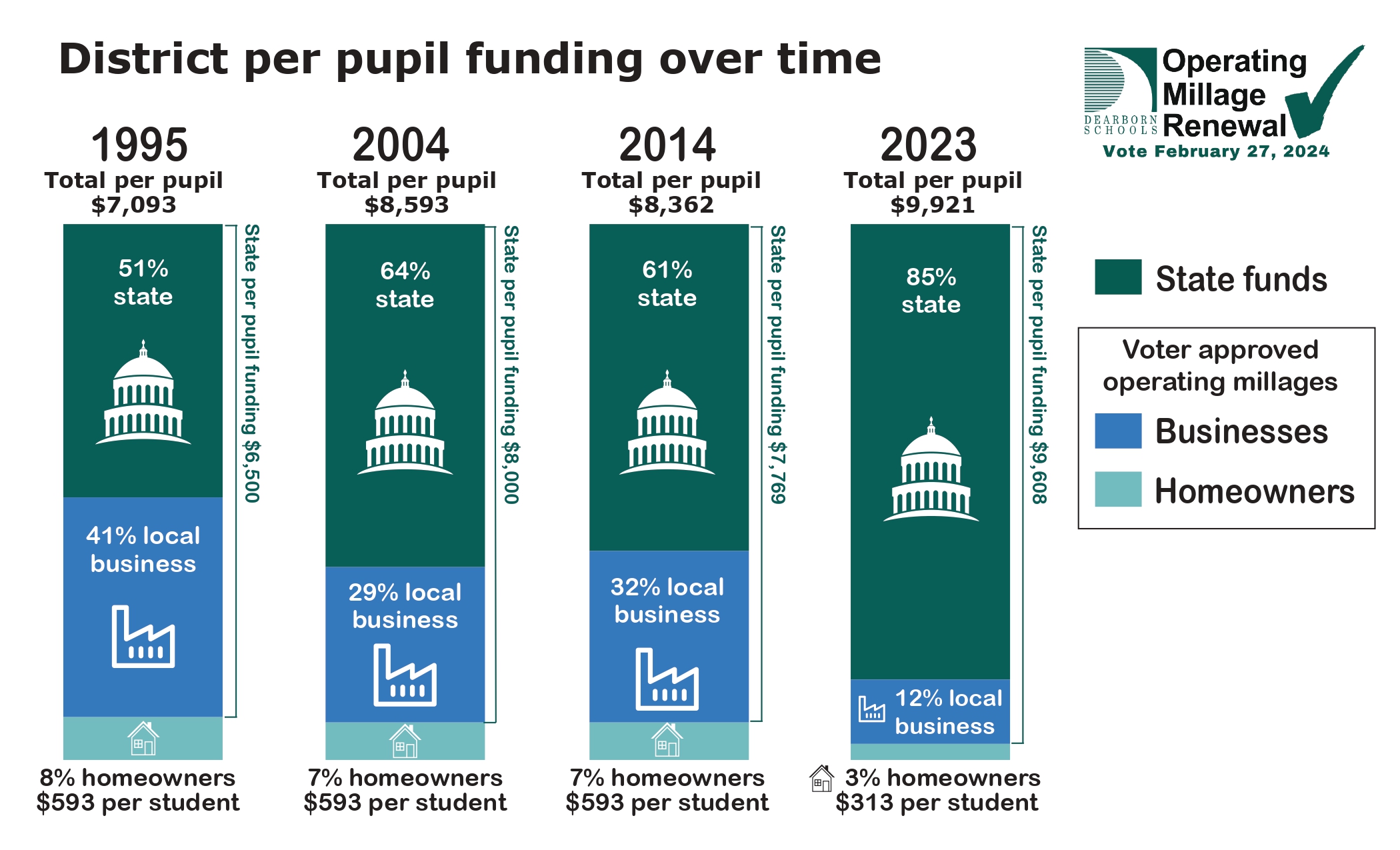

Per pupil funding since Proposal 1

In 1994, state voters approved Proposal A, which dramatically changed how school districts are funded in Michigan. Most funding now is determined by the state.

When Proposal A passed, several school districts, including Dearborn Public Schools, already had voter-approved funding higher than what the state was going to provide. These districts were allowed to continue to collect some taxes from local homeowners to avoid dramatic reductions in their funding.

Under Proposal A, all districts are expected to collect 18 mills from local business properties.

The portion of Dearborn Public Schools per pupil funding from local homeowners and businesses has fallen considerably since voters last approved the district’s operating millage in 2014.

Importance of operational millage

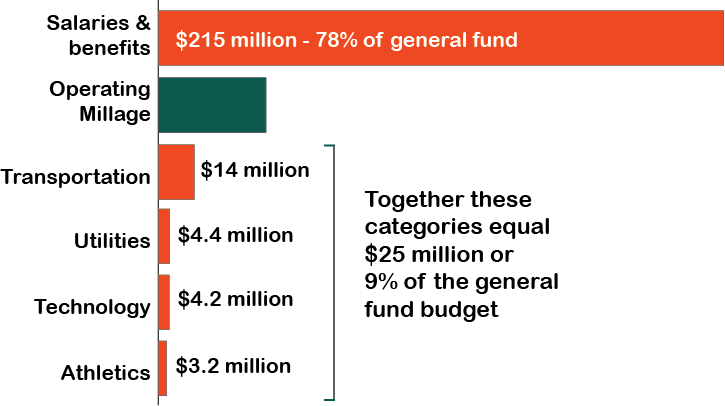

While the district has other funding sources, the General Fund is the only revenue that can be used for any regular district expenses.

The largest line item in the general fund is salary and benefits, which make up almost 80 percent of that budget.

Here are some common funding areas to provide a better perspective of where general fund dollars are spent compared to the $41 million generated from the Operational Millage.

The loss of 16 percent of the general fund would force the district to cut staff.

More resources

For more information about the Operational Millage Renewal, check out the resources below.

Operating Millage Renewal slide presentation

Operating Millage Renewal quick facts

School Matters podcast on Operating Millage Renewal

Press release announcing operating millage renewal question

Get 2 to Vote campaign and voter information

Frequently Asked Questions about the Operating Millage Renewal

Resolution to put the renewal on the ballot

تجديد ألفية التشغيل

Countdown until polls close Feb. 27, 2024

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)